Summary:

-

- Banking Milestone: HDFC Bank has opened its first branch in Kavaratti Island, Lakshadweep, marking the first private sector bank presence in the region.

-

- Financial Inclusion: The new branch aims to enhance banking accessibility, offering services like loans, deposits, and digital banking to the islander.

-

- Economic Impact: This initiative is expected to boost economic activity and promote digital banking, contributing to Lakshadweep’s economic growth.

What is the news?

-

- For the residents of Lakshadweep, a chain of islands nestled in the Arabian Sea, access to mainstream banking services has long been a challenge. However, a recent development marks a significant milestone in financial inclusion for the Union Territory.

-

- HDFC Bank has established its first branch in Kavaratti Island, Lakshadweep, becoming the first private sector bank to do so. This editorial explores the significance of this development and its potential impact on the region’s economic growth.

Bridging the Gap: Financial Inclusion in Lakshadweep

-

- Prior to HDFC Bank’s arrival, banking options in Lakshadweep were limited primarily to a few government-owned banks. This limited access often posed challenges for islanders seeking financial services like loans, deposits, and digital banking solutions. The geographical isolation of Lakshadweep further accentuated these limitations.

HDFC Bank’s Initiative: Expanding Financial Landscape

HDFC Bank’s decision to open a branch in Lakshadweep signifies a commitment to financial inclusion and serving a previously underserved population. This move holds the potential to:

-

- Enhance Accessibility: With a physical presence, Lakshadweep residents will have easier access to a broader range of banking products and services. This can simplify tasks like depositing income, applying for loans, or utilizing digital banking options.

-

- Boost Economic Activity: Increased access to financial services can stimulate economic activity in Lakshadweep. Small businesses and entrepreneurs can benefit from loans to invest and grow, while individuals can avail of personal loans for various needs.

-

- Promote Digital Banking: HDFC Bank’s focus on digital solutions can encourage the adoption of cashless transactions in Lakshadweep. This can lead to greater financial transparency and efficiency.

Challenges and Opportunities: The Road Ahead

While HDFC Bank’s initiative is a positive step, there are challenges to consider for long-term success. These include:

-

- Digital Literacy: Promoting digital banking solutions in a region with varying levels of digital literacy may require additional support and training initiatives.

-

- Infrastructure Development: Reliable internet connectivity is crucial for seamless digital banking experiences. Ensuring robust internet infrastructure will be essential for full utilization of these services.

-

- Despite the challenges, the potential benefits of HDFC Bank’s presence outweigh the hurdles. By actively collaborating with local authorities and residents to address these challenges, HDFC Bank can create a truly inclusive banking environment in Lakshadweep.

Conclusion:

-

- HDFC Bank’s establishment of a branch in Lakshadweep represents a significant step forward for banking accessibility in the Union Territory. This initiative holds the potential to empower individuals, support businesses, and contribute to Lakshadweep’s overall economic development. As the bank navigates the challenges ahead, its commitment to financial inclusion will be crucial in ensuring a bright and financially secure future for the islands and its residents.

About Lakshadweep: A Paradise in the Arabian Sea

-

- Lakshadweep, a chain of 36 islands and coral reefs scattered across the vast expanse of the Arabian Sea, is a captivating Union Territory of India. Imagine turquoise waters lapping against pristine beaches, vibrant coral reefs teeming with life, and swaying coconut palms framing idyllic lagoons. Lakshadweep embodies this tropical paradise, offering a unique blend of geography, culture, and history. Let’s embark on a geographical exploration of this captivating archipelago.

Location and Physical Geography:

-

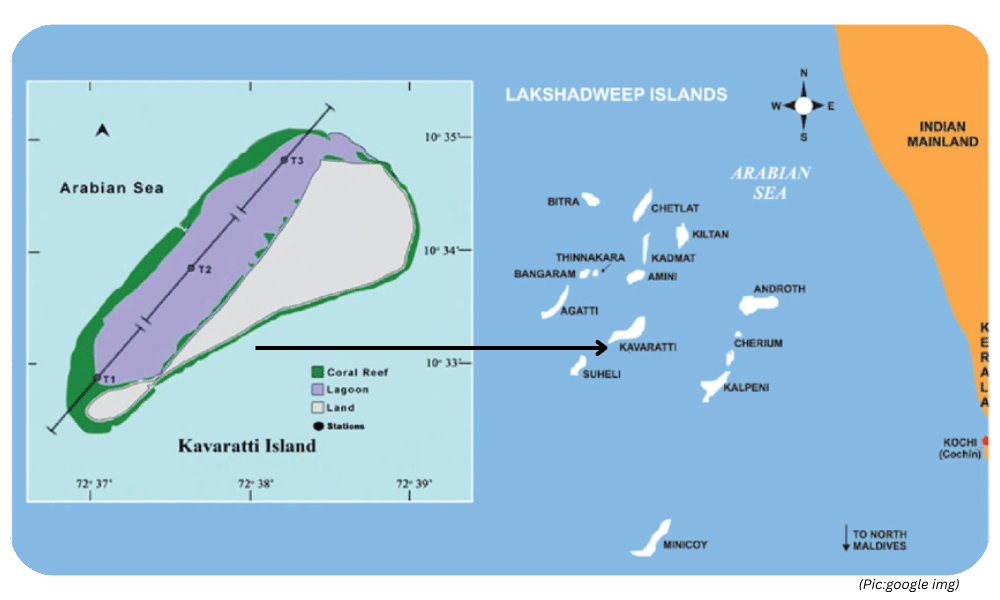

- Lakshadweep lies roughly 400 kilometers off the coast of Kerala, nestled between 10° and 12° North latitude and 72° and 74° East longitude.

Comprised of 12 atolls, three reefs, five submerged banks, and ten inhabited islands, the total land area is a mere 32 square kilometers. Kavaratti Island, the administrative capital, is the largest island in the archipelago.

- Lakshadweep lies roughly 400 kilometers off the coast of Kerala, nestled between 10° and 12° North latitude and 72° and 74° East longitude.

-

- Lakshadweep is a product of volcanic activity millions of years ago. These submerged volcanoes formed the base upon which coral reefs grew, eventually creating atolls – ring-shaped coral islands surrounding a lagoon.

Climate:

-

- Lakshadweep enjoys a tropical monsoon climate with warm temperatures year-round. Average temperatures range from 24°C to 32°C, with high humidity levels. The southwest monsoon (June to September) brings abundant rainfall, making the islands lush and green.

Flora and Fauna:

-

- Lakshadweep’s flora is dominated by coconut palms, the lifeblood of the island economy. Other tropical vegetation includes breadfruit trees, banyan trees, and a variety of shrubs. The coral reefs surrounding the islands are a treasure trove of marine biodiversity. Schools of colorful fish, vibrant coral formations, and diverse marine life thrive in these warm waters.

People and Culture:

-

- The indigenous people of Lakshadweep, known as Lakshadweepis, have a rich cultural heritage. Their way of life is deeply connected to the sea, with fishing and coconut cultivation forming the mainstay of their livelihood. Their unique language, Malayalam with influences from Arabic and Sanskrit, reflects their cultural tapestry. Traditional music and dance forms like Lakshadweep Kavdi and Kolkalli add vibrancy to their lives.

Challenges and Opportunities:

-

- Lakshadweep faces unique challenges due to its remote location and limited landmass. Freshwater scarcity, vulnerability to climate change and rising sea levels, and the need for sustainable development are pressing concerns. However, the islands also hold immense potential for tourism, fisheries, and renewable energy development (solar and wind power).

Conclusion:

-

- Lakshadweep is a captivating mosaic of geography, culture, and natural beauty. Understanding its geographical context allows us to appreciate its unique ecosystem and the challenges and opportunities it presents. As responsible tourists and global citizens, we must strive to preserve this fragile paradise while promoting sustainable development for the well-being of its people.

QuizTime:

Mains Questions:

Question 1:

Evaluate the significance of HDFC Bank opening its first branch in Lakshadweep, considering the challenges and opportunities associated with financial inclusion in the island territory. Suggest measures to ensure the success of this initiative.(250 words)

Model Answer:

Significance of HDFC Bank’s Branch:

-

- Financial Inclusion: HDFC Bank’s presence expands access to a broader range of financial services for Lakshadweep residents. This can empower individuals and businesses by simplifying access to loans, deposits, and digital banking solutions.

- Economic Growth: Increased access to financial services can stimulate economic activity. Small businesses and entrepreneurs can benefit from loans to invest and grow, while individuals can avail of personal loans for various needs.

- Digital Banking Promotion: HDFC Bank’s focus on digital solutions can encourage the adoption of cashless transactions in Lakshadweep, leading to greater financial transparency and efficiency.

Challenges and Opportunities:

-

- Digital Literacy: Promoting digital banking solutions in a region with varying levels of digital literacy might require additional support and training initiatives.

- Infrastructure Development: Reliable internet connectivity is crucial for seamless digital banking experiences. Ensuring robust infrastructure will be essential for full utilization of these services.

- Limited Awareness: Residents might not be fully aware of the benefits and functionalities offered by formal banking services. Financial literacy campaigns are necessary.

Measures for Success:

-

- Collaboration: HDFC Bank should collaborate with local authorities and NGOs to raise awareness about financial products and services.

Financial Literacy Programs: Organizing workshops and training programs can equip islanders with the necessary skills to navigate digital banking platforms. - Offline Support: Maintaining a physical branch presence, alongside digital options, caters to those who prefer traditional banking methods.

Localized Communication: Providing information and customer support in local languages can improve accessibility and understanding.

- Collaboration: HDFC Bank should collaborate with local authorities and NGOs to raise awareness about financial products and services.

By addressing these challenges and implementing these measures, HDFC Bank can ensure the success of its Lakshadweep branch and contribute meaningfully to financial inclusion in the island territory.

Question 2:

HDFC Bank’s initiative in Lakshadweep can be seen as a part of the larger national goal of financial inclusion. Discuss the importance of financial inclusion for India’s economic development and suggest strategies for achieving it effectively.(250 words)

Model Answer:

Importance of Financial Inclusion:

-

- Economic Growth: Financial inclusion fosters economic activity by enabling individuals and businesses to access credit, invest, and save. This fuels entrepreneurship and job creation, contributing to overall economic growth.

- Poverty Reduction: Access to financial services like microloans empowers underprivileged individuals to start small businesses, generate income, and move out of poverty.

- Financial Stability: Formal banking promotes financial stability by encouraging savings and providing secure alternatives to informal lenders with high-interest rates.

Strategies for Effective Financial Inclusion:

-

- Expanding Branch Network: Increasing the physical presence of banks, particularly in rural and remote areas, is crucial for accessibility.

Digital Banking Initiatives: Promoting digital banking through mobile wallets and online platforms provides greater financial access, especially for those in geographically challenging locations. - Financial Literacy Programs: Educating people about financial products, responsible borrowing, and budgeting practices empowers them to make informed financial decisions.

- Government Schemes: Government initiatives like Pradhan Mantri Jan Dhan Yojana and Stand Up India provide subsidized loans and financial support to underprivileged groups.

- Expanding Branch Network: Increasing the physical presence of banks, particularly in rural and remote areas, is crucial for accessibility.

HDFC Bank’s initiative in Lakshadweep exemplifies the importance of expanding financial inclusion across the country. By implementing a multi-pronged approach that combines infrastructure development, digital literacy initiatives, and targeted government schemes, India can achieve significant progress towards financial inclusion for all its citizens.

Remember: These are just sample answers. It’s important to further research and refine your responses based on your own understanding and perspective. Read entire UPSC Current Affairs.

Relevance to the UPSC Prelims and Mains syllabus under the following topics:

Prelims:

-

- GS Paper I: Economy: Although not a specific question about HDFC Bank, the Prelims might ask about government initiatives or policies related to financial inclusion. Understanding the concept of financial inclusion and its benefits would be helpful.

Mains:

-

- GS Paper III – Indian Economy: This paper could have questions on financial inclusion strategies, the role of private banks in economic development, or challenges faced in reaching unbanked populations.

- GS Paper IV – Ethics, Integrity, and Aptitudes: This paper might have a case study-based question on HDFC Bank’s initiative, asking you to analyze its ethical implications, potential social impact, or challenges to responsible banking practices.

0 Comments